Using the Bootstrapped Market SOFR Caplet Normal Vol Surface to Price in Excel Interest Rate Caps/Floors on Backward/Forward Looking SOFR Term Rates - Resources

Libor Hájek 25 New York Rangers Fanatics Authentic Pro Locker Room HAT Player Team Issue | SidelineSwap

Libor Hájek 25 1 Hat New York Rangers Fanatics Authentic Pro Locker Room HAT Player Team Issue | SidelineSwap

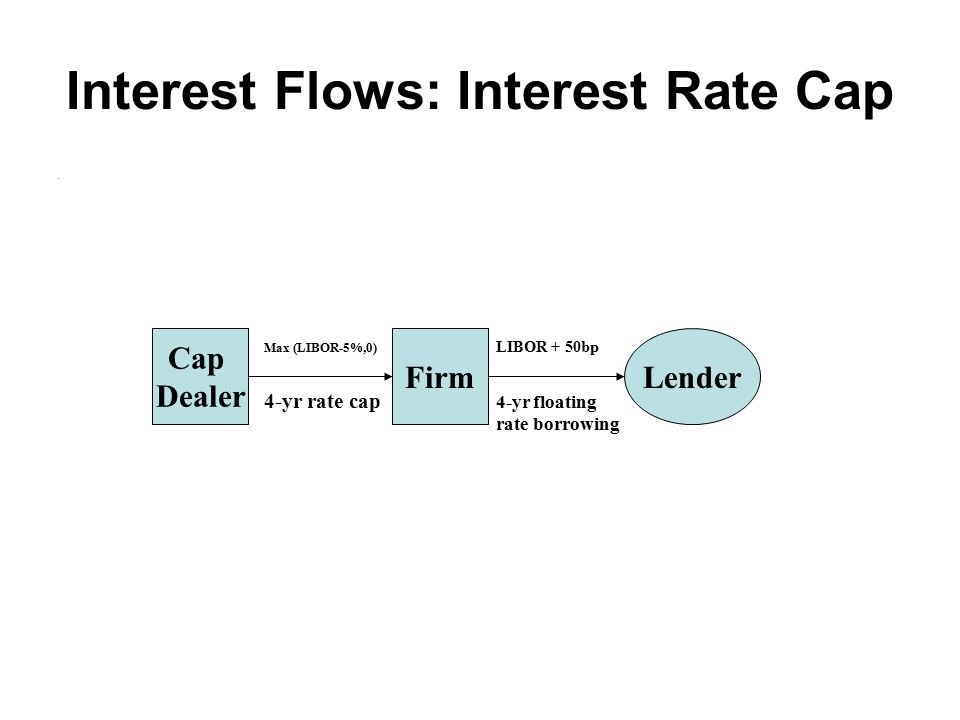

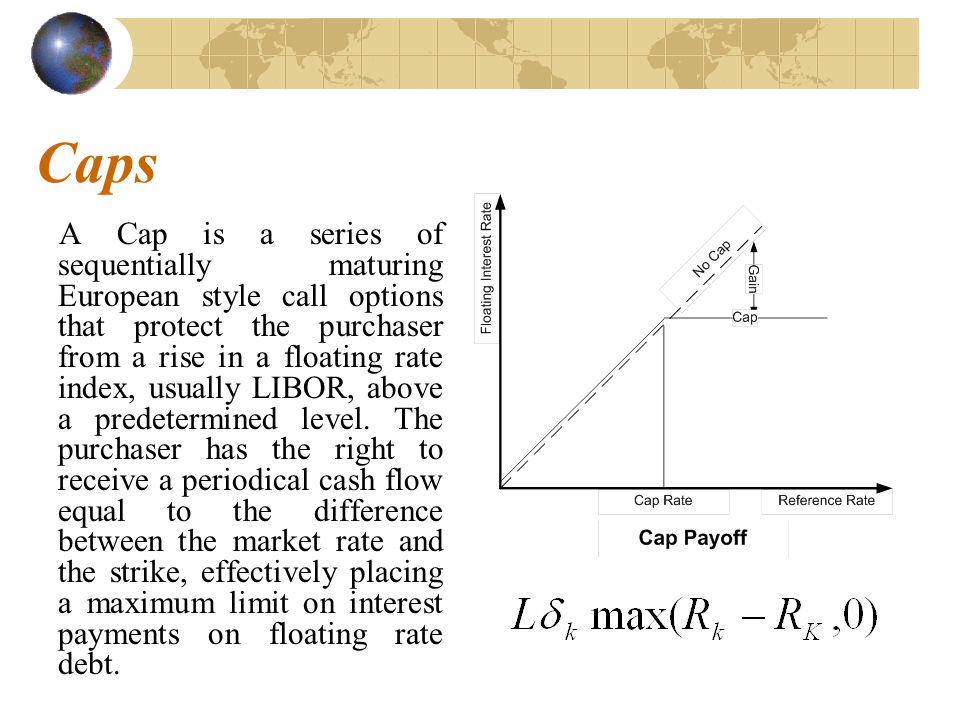

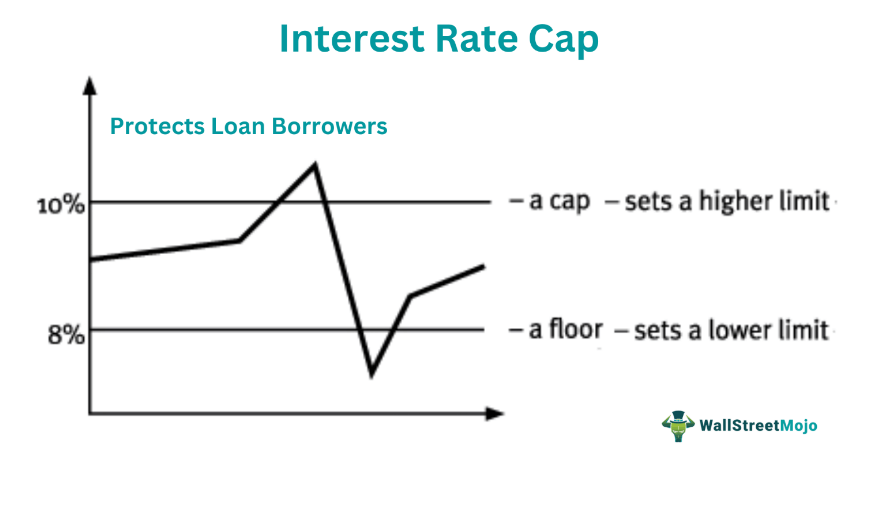

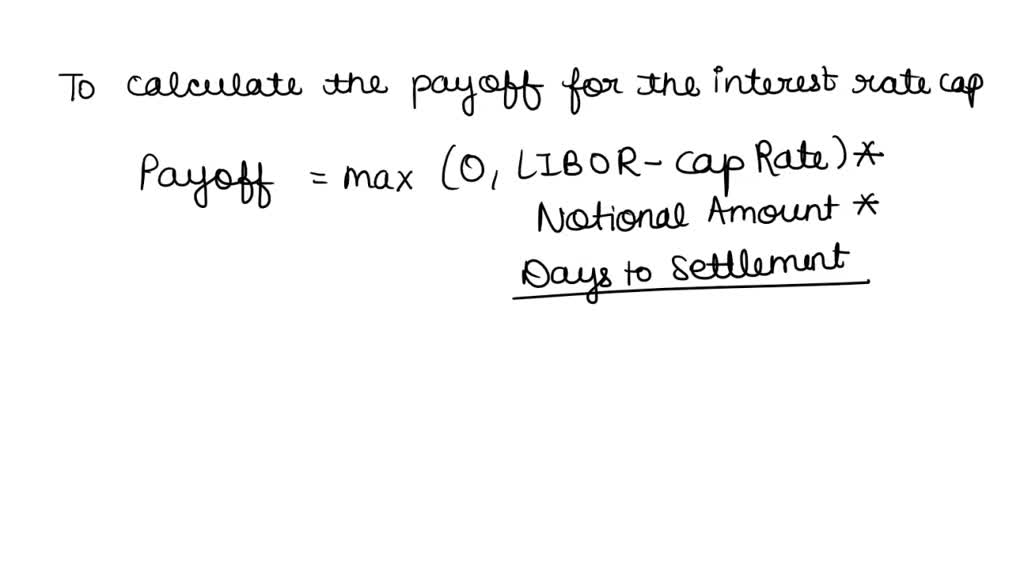

SOLVED: An international investment firm buys an interest rate cap that pays the difference between LIBOR and 6% if LIBOR exceeds 6%. Current LIBOR is 5%. The amount of the option is

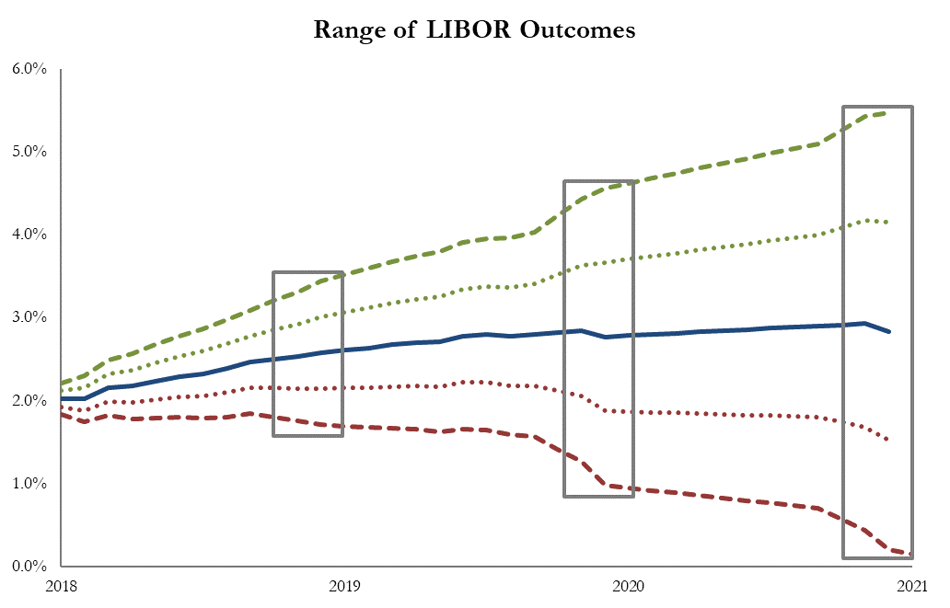

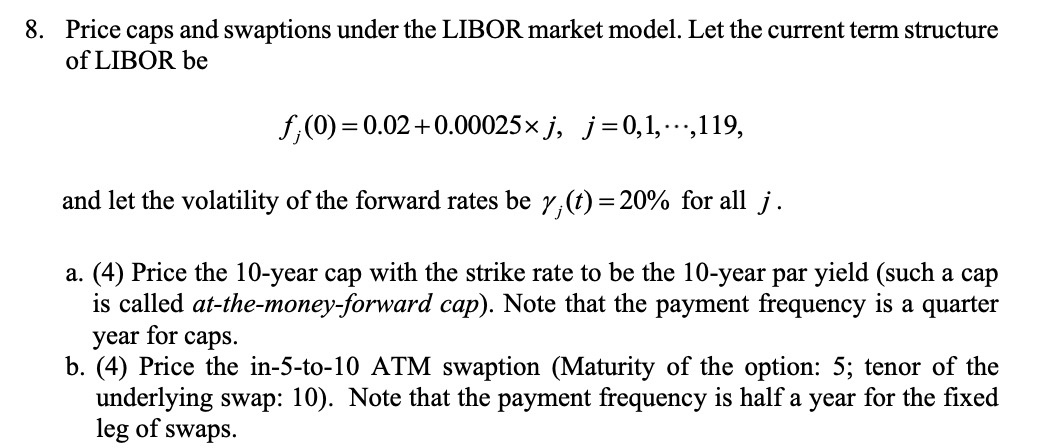

option pricing - Find the caplet volatilities for LIBOR fixings at each interval, given the ATM implied cap volatility term structure - Quantitative Finance Stack Exchange

![Interest Rate Cap Instrument—An Illustration - Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide [Book] Interest Rate Cap Instrument—An Illustration - Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide [Book]](https://www.oreilly.com/api/v2/epubs/9780470829059/files/images/f392-01.jpg)

Interest Rate Cap Instrument—An Illustration - Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide [Book]